statute of limitations colorado debt

The time for a debt to become time-barred varies from state to state. Click I Agree to the terms.

No Fresh Start In 2021 Will States Let Debt Collectors Push Families Into Poverty As Pandemic Protections Expire Web Version National Consumer Law Center

Colorado has statutes of limitations on the books for a wide range of injury claims and criminal charges.

. However in a July 2012 decision the Colorado Court of Appeals determined that if the lender does not accelerate the debt the statute of limitations does not begin to run until the. But before a creditor can start the creditor must go to court to receive a judgment. Most debts have a statute of limitations in the range of 3 to 6 years although some are legally enforceable for up to 15 years.

In the criminal law context these statutes dictate how long prosecutors have to file criminal charges. What Are the Civil Statutes of Limitation in Colorado. A All actions to recover a liquidated debt or an.

1 The following actions shall be commenced within six years after the cause of action accrues and not thereafter. After this period expires the court can no longer order you to repay your old debt and in most cases it doesnt make sense to do so. This stipulation is found in the same section of state law as the personal injury statute of limitations in Colorado.

Many types of legal claims or actions are subject to a time limit known as a statute of limitations. 2Clicking on this link takes you to a third-party website. Once the time is completed the creditor has no legal rights to demand debt.

Some states have limitations as short as three years while others keep debt active for up to 20 years looking at you Maryland. Beware of extending the statue of limitations. Whether you have credit card debt or you owe the IRS our debt relief and tax attorneys may be able to help.

1On April 12 2011 the governor signed House Bill 2412 into law. 1 The following civil actions regardless of the theory upon which suit is brought or against whom suit is brought shall be commenced within two years. Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

Ad The Leading Online Publisher of National and State-specific Collection Legal Documents. The statute of limitations is the period of time when a creditor or debt collector can file a lawsuit against you to recoup the money you owe. But if the collection agencys attempt to collect the debt fails the agency can sue the debtor within six years.

In Colorado most types of debt have a statute of limitations of six years. Get Assistance Managing Which Debts to Pay First and How Much to Pay. The statute of limitations refers to the time limit a creditor has to enforce a debt by way of a lawsuit.

This bill amends Section 12-548 of the state code and makes the statute of limitations for credit card debt six years. Schedule an assessment at 303 688-0944. Colorados time limits for filing a civil action generally range from one to three years but rent and debt collection actions have a six-year limit.

Colorados statute of limitations period is extended by the same period of the IRS federal waiver. The Colorado Supreme Court acknowledged a debt owed for medical services was liquidated because it involved itemizing services provided based on pre-determined rates even. Generally the statute of limitation for most consumer debts arising from written contracts in California expires after four years.

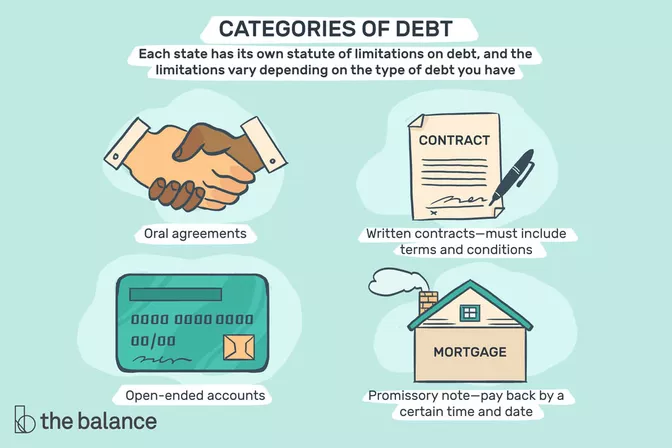

Under FTC Settlement Debt Buyer Agrees to Pay 25 Million for Alleged Consumer Deception. In simple terms the statute of limitations on debt collection by state is a period by which a creditor can ask for debt. These statutes of limitations range from Three Years for certain contracts to 20 years for District Court.

Most debts in Colorado have a statute of limitations of six years. However oral contracts have a two-year limit in The Golden State as California is famously referred to. Unlike federal loans private student loans do have a statute of limitations.

A creditor may not successfully sue you beyond the time period provided in the statue of limitations. Ad Take Some of the Stress Out and Get Help Managing Debt. Under Colorado law taxpayers may waive their state tax limitations periods by entering into a written agreement with the Department of Revenue.

The state also provides an extra year three total for personal injury and injury to property claims if a motor vehicle is involved. The statute of limitations in Colorado. Just like determining which statute of limitation may apply to your case navigating the accrual date under these circumstances can be tricky.

Colorado Statutes of Limitations. Colorado Revised Statute 13-80-1035 sets forth the following time limitations for the collection of a debt. If the statute of limitations has passed there may be less incentive for you to pay the debt.

Colorado puts a limit on how long creditors can seek to collect on old debts. However the period varies by the state laws and type of debts. Before you respond to a debt collection find out the debt statute of limitations for your state.

It varies from state to state. There is one very important piece of advice when dealing with debt collectors. The law gives creditors several means of collecting delinquent debt.

This time period is not the same as the length of time a debt may stay on your credit report. 51 rows Usually it is between three and six years but it can be as high as 10 or 15 years in some states. Here are some of Colorados statutes of limitations for consumer-related issues.

An experienced bankruptcy lawyer can look into your case to determine whether the statute of limitations for the debt has run out or whether. Once the statute of limitations on debt has passed your debt becomes time-barred and debt collectors can no longer sue you and force you to pay. The statute of limitations for wrongful death cases is two years.

This includes credit card debts auto loans personal loans private student loans and medical debts. The most common timeframe is 6 years. This memorandum provides an overview of statutes of limitations including factors that impact length such as statutes of repose and tolling.

The statute of limitations is the time within which a debt collector can sue you for unpaid debts. Colorados debt statute of limitations dictates that time frame. Generally the time ranges from ten to fifteen years.

Click on the Colorado Revised Statutes link on the left column. Colorado Statues of Limitation. This is because Colorados statute of limitations on debt is six years.

If the credit reporting time limit a date. This debt may include credit cards mortgages auto. The memorandum also includes tables listing the various criminal and civil statutes of limitations and statutes of repose in the state.

3 or 6 13-80-101 or 13-80-1035. The statute of limitations usually starts from the date an account. Conventional wisdom has been that collection actions had to be brought by lenders within six years from the date the loan first went into default.

Debt Collection In Colorado Know Your Rights Wink Wink

What Is The Statute Of Limitations On Collecting A Debt In Colorado

Debt Collection Laws Know Your Rights Lexington Law

Debt Collection In Colorado Know Your Rights Wink Wink

Why Do Banks Keep Going Bankrupt Kirby R Cundiff Bankruptcy Managing Your Money Filing Bankruptcy

Colorado Debt Debt Collection Laws Statute Of Limitations Lendingtree

How Long Can A Debt Collector Legally Pursue Old Debt

Colorado Statute Of Limitations On Debt

Public Colleges In 49 States Send Students Debts To Collection Agencies Imperiling Financial Futures

Colorado Debt Statute Of Limitations Robinson Henry P C

Understanding The Statute Of Limitations On Debt Collection Mmi

Fair Debt Collection Practices Act What You Should Know

Know Your Rights In Dealing With Debt Collectors The Denver Post

What Is A Statute Of Limitations On A Debt Consumer Financial Protection Bureau

What Is The Statute Of Limitations For Medical Debt Nfcc National Foundation For Credit Counseling

Attorney General Josh Stein Calls On Consumer Financial Protection Bureau To Protect Consumers From Zombie Debt Ncdoj

Statute Of Limitations On Debt Collection By State In 2022

Your State By State Guide To Statute Of Limitations On Debt Student Loan Hero

State By State List Of Statute Of Limitations On Debt And Why Texas Doesn T Have One For Mortgage Debt Laws In Texas